Table of Contents

How Much Money Do You Need to be a Swing Trader?

A swing trader aims to profit from medium-term price movements lasting a few days to several weeks. Swing traders analyze and trade on a daily timeframe, allowing them to balance work and other activities. But how much money do you need to be a swing trader?

There is no minimum capital need to begin swing trading stocks because it involves far less capital than other types of trading. You can start with just a few hundred dollars. However, there are a few elements to consider when determining how much money to utilize for swing trading.

In this article, we will cover the criteria that affect how much you need to be a swing trader, which includes:

- Your acceptable account risk

- The price of the stock you want to buy

- Trading commission

- Other costs

Acceptable Account Risk

One of the most important elements to consider when determining how much money you need to start swing trading stocks is your tolerable account risk. This is the proportion of your account you are willing to risk in each trade. It is frequently recommended to keep this modest — approximately 1-3% — especially if you are a beginner trader, to decrease the danger of experiencing a massive drawdown or possibly losing your trading account.

To trade sensibly priced stocks and cover your stop loss, start with a bigger quantity of money than you’re ready to risk per trade. More about that in the next part.

The Price of the Stock you want to Buy

The price of the stock you wish to purchase is another aspect that influences the amount of capital required. A stock might cost anything from a few cents to thousands of dollars. If you want to trade pricey stocks while keeping the percentage of your account risked in each trade to an acceptable level, you’ll need a large amount of capital.

For example, if you wish to buy a $700 stock with a 10% stop loss and risk only 1% of your account size, a $1,000 account is insufficient. You’ll need a $7,000 account. Let us work it out:

- Without slippage, your risk in the trade is 10% of $700 = $70.

- $70 is 7% of $1,000, which is significantly higher than the allowable 1% risk per trade.

- $70 is 1% of $7,000, hence the minimum capital required is $7,000.

- If you are ready to risk 2% of your capital per trade, you will require $3,500 capital.

- If you lack the necessary funds, consider trading inexpensive stocks.

Trading Commission

The commission is the fee that your broker charges for the execution of your trade, and it can quickly eat into your profits or increase your losses. Typically, commissions are fixed dollar amounts, necessitating higher trading volume to keep costs low. However, trading more shares every trade requires additional capital. Look for brokers with reduced commissions. Some brokers now offer trading without any commissions.

Other Costs to Consider

Here are some of the other costs that you will affect your minimum capital requirement:

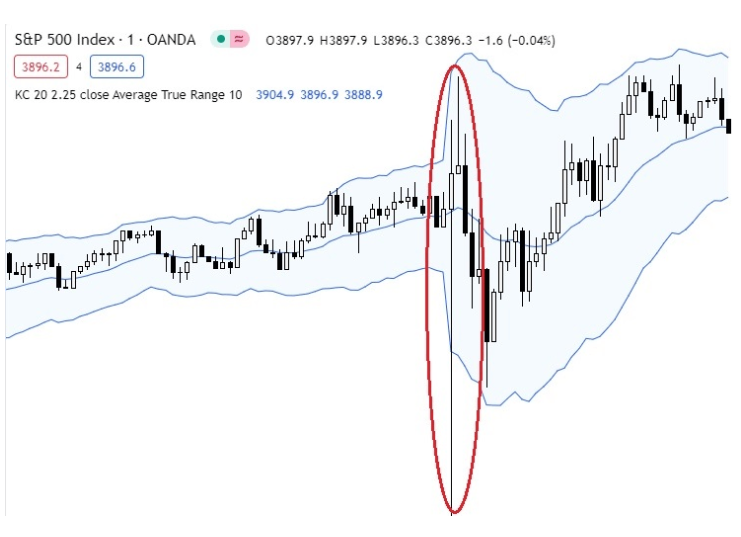

- Slippage: When the market is volatile and lacks liquidity, your order may be executed at a lower price than expected. It affects your risk management. With slippage, your stop loss order may be executed at a lower price, causing you to lose more than you intended.

- Trading software: You must examine the expense of your trading program.

- Live data: This is dependent on the market you’re dealing and your broker. Live data might cost anywhere from $0 to several hundred dollars per year.

- Historical data: To construct your own swing trading methods, consider purchasing historical data for back testing.

- Taxes: You also have to pay taxes on your profits.

Final Comments

If you’re starting with a $1,000 account, you’ll want to keep expenditures minimal. Look for brokers who charge little to no commission. Some of them provide free charting and trading interfaces. Do not buy stocks that cost hundreds of dollars and avoid penny stocks because they are illiquid and volatile. Concentrate on equities that trade between $10 and $70.

Frequently Asked Questions

What factors determine how much money is needed for swing trading?

The essential criteria are your acceptable account risk, the price of the stock you intend to purchase, the trading commission, and any other associated costs. There are no strict minimum capital requirements. Swing trading takes less capital than other trading strategies, allowing you to start with as little as a few hundred dollars.

What is acceptable account risk, and how does it influence the capital needed?

Acceptable account risk is the percentage of your account that you are willing to risk on each deal. Keeping this low (about 1-3%) is recommended to reduce the danger of large drawdowns. However, lesser risk percentages may necessitate greater trading money.

How can traders keep costs low when starting with a smaller account, such as $1,000?

To keep costs low, traders starting with a small account should look for brokers with minimal or no commissions, free charting and trading interfaces, and concentrate on stocks trading between $10 and $70 to maximize capital usage.